Why Refinancing in 2025 Could Be Your Smartest Financial Move Yet

Introduction With the Reserve Bank of Australia (RBA) reducing the cash rate to 4.10% in February 2025, homeowners have a prime opportunity to reassess their mortgage arrangements. Benefits of Refinancing Lower Interest Rates: Many lenders have reduced their rates, offering competitive deals to attract borrowers. Reduced Monthly Repayments: Lower rates…

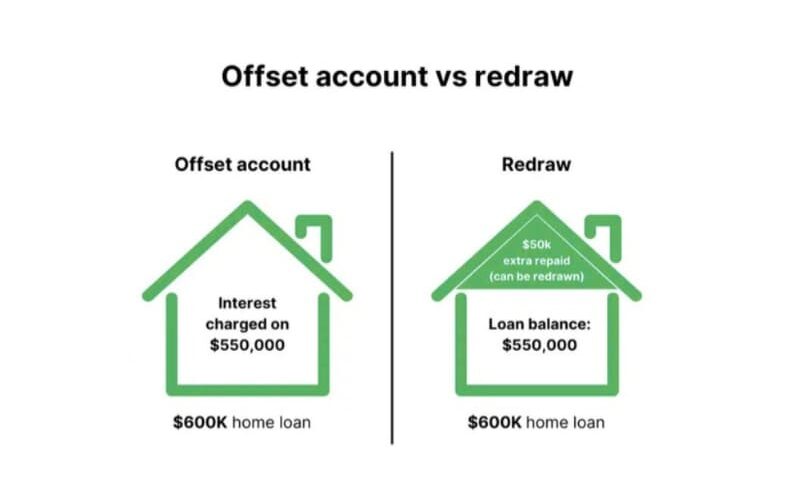

Offset Account vs Redraw Facility: Which One Could Save You More?

Introduction When managing your home loan, choosing the right features can lead to significant savings. Two popular options are offset accounts and redraw facilities. Let’s delve into their differences to help you make an informed decision. Offset Account What is it? An offset account is a transaction account linked to…

2025 Home Buying Guide: Grants, Schemes & What First Home Buyers Need to Know

Introduction Entering the property market as a first home buyer in 2025? Good news! Various federal and state initiatives are designed to make your journey smoother and more affordable. Here’s a comprehensive guide to help you navigate the available grants and schemes. Federal Initiatives First Home Guarantee (FHBG): Allows eligible…

RBA Cash Rate- What it means for you and your mortgage

The Reserve Bank of Australia (RBA) has announced a significant change to the official cash rate, dropping it to a new low. This move aims to stimulate economic growth by reducing borrowing costs for homeowners, investors, and businesses alike.

So, what does this mean for you? Let’s break it down in simple terms.

Why Mortgage Brokers Are More Relevant Than Ever in 2025

Navigating the Australian property market can feel like solving a complex puzzle, especially with evolving financial regulations, fluctuating interest rates, and an abundance of lending options. For many Australians, the role of a mortgage broker has become more crucial than ever in 2025. Whether you’re a first-time buyer, a seasoned…

How to Make Your Homeownership Dreams a Reality

Owning a home is one of the most significant milestones in life. Whether you’re a first-time homebuyer or looking to expand your property portfolio, the journey can feel overwhelming. At DreamQi Financial, we’re here to guide you through every step of the process and help you turn your dreams into…

Is Now the Right Time to Buy a Home or Invest in Property? Insights into Australia’s Current Market

The Australian housing market has always been a focal point for aspiring homeowners and seasoned investors alike. As 2025 unfolds, the property market is presenting unique opportunities for both first-time buyers and investors. Let’s dive into why now might be the perfect time to enter the market. The Current State…

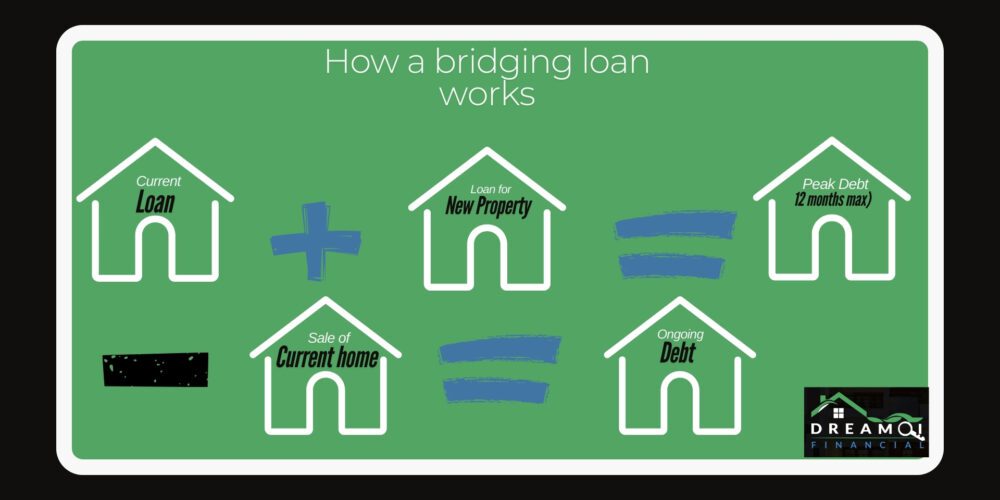

Bridging Loans: How They Work, Benefits, and Choosing the Right One

Bridging loans are a specialised financial solution designed to help individuals and families manage the gap between selling an existing property and purchasing a new one. Whether you’re upgrading your home, downsizing, or venturing into property investment, understanding how bridging loans work can make your transition smoother and more financially…