Introduction

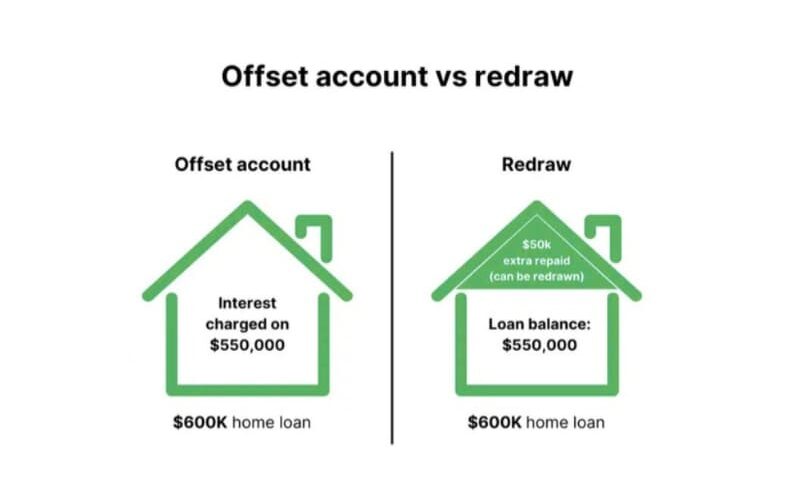

When managing your home loan, choosing the right features can lead to significant savings. Two popular options are offset accounts and redraw facilities. Let’s delve into their differences to help you make an informed decision.

Offset Account

What is it? An offset account is a transaction account linked to your home loan. The balance in this account offsets your loan balance, reducing the interest charged.

Benefits:

- Immediate access to funds.

- Reduces interest payable on your home loan.

- Functions like a regular transaction account.

Considerations:

- May come with higher fees or interest rates.

- Not all loans offer 100% offset features.

Redraw Facility

What is it? A redraw facility allows you to make extra repayments on your loan and withdraw them later if needed.

Benefits:

- Helps reduce the loan principal and interest payable.

- Encourages disciplined saving.

- May have lower fees compared to offset accounts.

Considerations:

- Accessing funds may take time.

- Some lenders impose minimum redraw amounts or fees.

Which One is Right for You?

- Choose an Offset Account if: You prefer easy access to your funds and want a flexible transaction account.

- Choose a Redraw Facility if: You’re comfortable with less frequent access to extra repayments and aim to reduce your loan principal.

Conclusion

Both features offer unique advantages. Your choice depends on your financial habits and goals. Consult with a mortgage broker to determine the best fit for your circumstances.

This Post Has 0 Comments